The Scruton solar plant, currently being developed by Ampyr Solar Europe in North Yorkshire, is set to be funded by Nord/LB, the German energy transition bank.

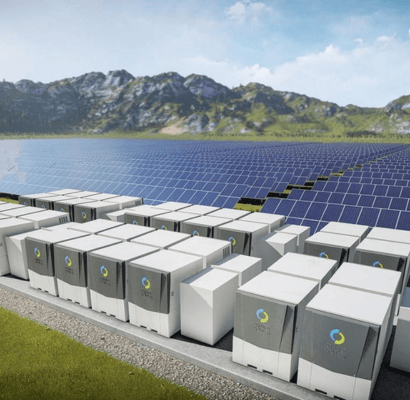

The project will feature nearly 90,000 new ground-mounted solar panels, generating clean energy for approximately 19,000 medium-sized households.

This marks the second Ampyr project to secure financing through the facility, following the Northwold Solar PV project in Norfolk, which is expected to reach its Commercial Operation Date (COD) in the first quarter of 2025.

The project's long-term viability will be guaranteed through a 15-year Contract for Difference (CfD) agreement with National Grid.

Construction of the Scruton plant is due to begin in July this year, with operations expected to commence in 2026. The project’s development will continue with a second phase, which will involve the addition of a Battery Energy Storage System (BESS) to the site.

Head of Energy Origination Europe at NORD/LB Niels Jakeman said: “This deal demonstrates our deep commitment to advancing the renewable energy transition in the UK and Europe more broadly.

The Scruton solar farm will help to increase the UK’s solar capacity significantly, and we’re thrilled to continue supporting Ampyr Solar Europe on its mission to accelerate the rollout of solar power across Europe.”

For more information regarding these projects, or to discuss current opportunities in the onshore renewables sector, please contact a member of our Onshore Renewables team on onshore@lsprenewables.com

Sources