Floating offshore wind is poised to transform the renewable energy sector, but new data suggests the industry must urgently recalibrate expectations. At LSP Renewables, we’ve long believed in its potential - but the latest research from Westwood Global Energy Group signals caution, particularly among developers.

In this article, we break down what’s driving this shift in sentiment - and what must change to unlock the sector’s promise.

Confidence in Floating Wind Drops Amid Structural Barriers

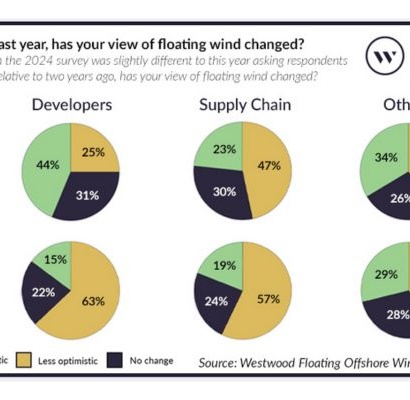

Westwood’s 2025 Floating Offshore Wind Survey, based on input from 166 stakeholders—including renewable energy developers, engineering firms, government bodies, and the offshore wind supply chain—reveals a clear drop in confidence across the board.

While 2024 saw promising developments such as new seabed leasing rounds, floating wind auctions, and increased attention from energy ministries, progress is now stalling due to:

- Delivery delays in key infrastructure projects

- Investor hesitancy around unproven technologies

- Slow, fragmented policy execution at national and regional levels

Developer Sentiment Takes a Sharp Turn

The biggest change is among developers - previously the most optimistic group - 63% now report reduced confidence compared to last year. This aligns with what our team at LSP Renewables hears daily from clients across floating turbine manufacturing, project resourcing, and offshore energy recruitment.

Although the ambition for floating wind remains, the path to deployment has become increasingly complex.

Revised Expectations: Less Than 3GW by 2030

The majority of respondents now expect less than 3GW of global floating wind capacity to be installed by 2030—a stark contrast to the bold targets initially envisioned in many climate action plans.

This signals a critical need for industry-wide recalibration.

What’s Holding Floating Wind Back?

Key barriers facing the sector include;

| Challenge | Description |

|---|---|

| Financial | High capital expenditure requirements and limited private sector confidence in newer floating technologies. |

| Infrastructure | Insufficient port infrastructure, lack of standardised substructures, and supply chain immaturity. |

| Policy | Inconsistent or delayed regulatory frameworks, including permitting timelines and auction clarity. |

As Bahzad Ayoub of Westwood Global Energy puts it, “Floating wind must be treated as a distinct sector.” We strongly agree. Unlike fixed-bottom turbines, floating wind projects require a different commercial model, bespoke logistics, and supportive regulation.

Policy Proactivity Drives Market Leadership

The data also shows a strong link between government action and market confidence. Countries like the UK, France, and South Korea - each with supportive floating wind strategies and clear procurement pipelines—are emerging as frontrunners.

This reinforces what we’ve seen at LSP Renewables: long-term visibility, investor clarity, and government-backed innovation programs drive real momentum.

Key Takeaways

- Confidence in floating wind has dipped sharply among developers.

- Delays, infrastructure shortfalls, and policy gaps are key barriers to deployment.

- Installed capacity forecasts for 2030 have been significantly downgraded.

- Countries with strong government strategies are leading the way.

- Industry collaboration is essential to unlock floating wind's full potential.

FAQs

Q: What is the main difference between floating and fixed-bottom offshore wind?

A: Floating wind platforms are anchored to the seabed via mooring lines, enabling deployment in deeper waters where fixed-bottom foundations are not feasible.

Q: Why are investors hesitant about floating wind?

A: Floating wind is still a relatively new technology with high capital costs and limited proven commercial-scale returns, leading to cautious investment behaviour.

Q: Which countries are leading floating wind development?

A: The UK, France, and South Korea are among the leaders, thanks to proactive policy frameworks and auction support mechanisms.

Q: What infrastructure is needed to scale floating wind?

A: Large-scale port upgrades, standardised floating platforms, and robust grid connection capacity are essential for scaling deployment.

Ready to Navigate the Floating Wind Transition?

At LSP Renewables, we’re actively supporting clients through this period of uncertainty. Whether you're scaling a project team, investing in offshore talent, or navigating regulatory change, we’re here to help.

Speak to one of our renewable energy specialists today to discuss how we can support your growth in floating offshore wind.